Quarterly Newsletter

Tyler Insurance Filings: 2025 year in review

A year of expanded electronic filing, stronger security, and smarter tools

Published: January 15, 2026

As we begin 2026, we are taking a moment to reflect on the enhancements and improvements delivered to Tyler Insurance Filings throughout 2025. This past year, our focus remained on reliability, modernization, and making insurance filings easier. From expanding electronic filing options to strengthening security and reporting, every update was guided by one goal: helping you file faster, more accurately, and with greater confidence.

Here is a look back at some of the key enhancements and resources introduced in 2025:

Advancing electronic filing and cloud fax capabilities

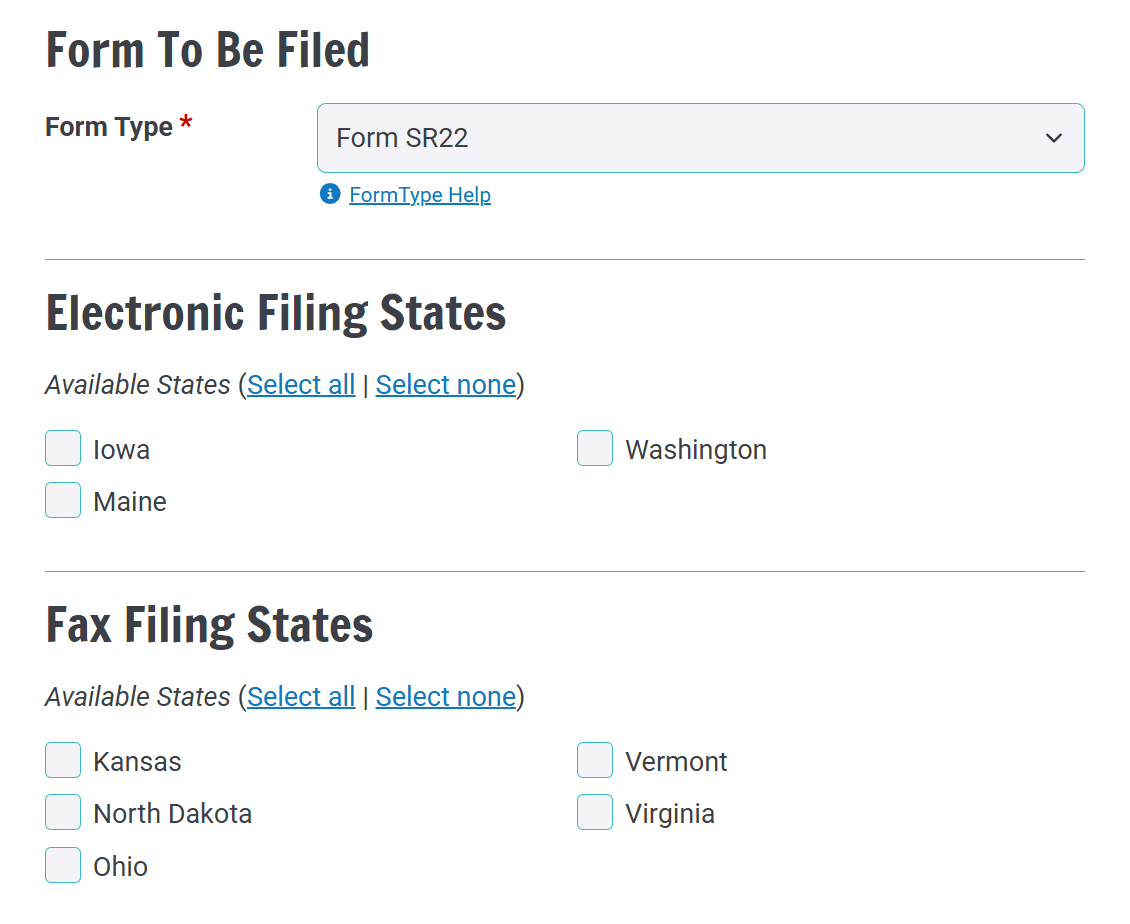

A major milestone in 2025 was expanding our cloud fax service to support SR-22 and SR-26 filings to Kansas, North Dakota, Ohio, Virginia, and Vermont. This enhancement reduces dependency on manual faxing, improves delivery tracking, and helps ensure filings reach the appropriate state agencies quickly and reliably.

By extending cloud fax support, Tyler Insurance Filings can help users streamline workflows while maintaining compliance with varying state requirements.

API enhancements and automation

Throughout 2025, we continued to invest in automation to support customers using system integrations. The addition of the California Department of Motor Vehicles Form MCP 67, Insurance Policy Endorsement, to the Tyler Insurance Filings API allows integrated customers to generate this document more efficiently, reduce manual efforts, and improve data consistency across systems.

These enhancements are part of our ongoing commitment to helping users scale operations with confidence.

Enhanced filing accuracy with Form E coverage type

In 2025, we also enhanced Form E filings by adding a coverage type field. This data provides clearer, more complete information for regulators at time of submission and helps reduce filing rejections, limits follow-up requests, and supports faster processing by state agencies.

By strengthening the data included in Form E filings, we continue to focus on improving first-pass acceptance and overall filing quality.

Improved reporting and administrative visibility

We also introduced enhanced reporting for Agency Administrators, giving teams better insight into filing activity, performance, and trends. In direct response to user feedback, state administrators now have access to more reports and can view detailed filing information as well as get a glimpse of agency user activity.

These improvements make it easier to access reports to monitor submissions and support internal oversight.

Security and account readiness

As always, security remained a key focus in 2025. We rolled out multifactor authentication (MFA) and single sign-on (SSO), helping customers strengthen account protection while simplifying access management. To support the transition, we also shared guidance to help customers ensure their accounts were ready for MFA.

This effort will continue throughout the first quarter of 2026 as Tyler Insurance Filings concludes this important upgrade, reinforcing the security of your organization's data and workflows.

Education to help you file with confidence

Throughout the last year, we published resources to help both new and experienced users navigate filings more efficiently, including:

- Avoiding common filing rejections

- Understanding expiration dates for filings

- Identifying and locating state motor carrier ID numbers

- Getting started with Tyler Insurance Filings

- Top customer support inquiries of 2025

These articles reflect our ongoing commitment to education, transparency, and reducing friction in the online filing process.

Looking Ahead

As 2026 gets underway, we are building on this momentum with continued investments in electronic filing, integrations, security, and usability. Thank you for trusting Tyler Insurance Filings as your partner ‐ we look forward to supporting your filing needs in the year ahead!